Federal Direct Loan Programs

About Federal Direct Loan Programs

Federal Direct Loans from the William D. Ford Federal Direct Loan Program are low-interest loans to help cover the cost of higher education at qualifying institutions. These loans must be repaid. Eligible students borrow directly from the U.S. Department of Education. Government loan terms and conditions may be more favorable than private student loan terms. Please note that upon approval, students’ loan information will be reported to the National Student Loan Data System and will be accessible by guaranty agencies, lenders, and schools determined to be authorized users of the data system.

There Are Several Types of Direct Loans:

Direct Subsidized Loans

Direct Subsidized Loans are for students with financial need. American College of Healthcare Sciences (ACHS) will review the results of your Free Application for Federal Student Aid (FAFSA) and determine the amount you are eligible to borrow. You are not charged interest while you are enrolled in school at least half-time [1] or during deferment periods.

Direct Unsubsidized Loans

You are not required to demonstrate financial need to receive a Direct Unsubsidized Loan. As with Direct Subsidized Loans, ACHS will determine the amount you are eligible to borrow. Interest accrues on an unsubsidized loan from the time of disbursement. Interest-only payments can be made of Direct Unsubsidized Loans while you are in school and during deferment or forbearance periods, or you can allow the interest to accrue and be capitalized (added to the principal amount of your loan). Note: capitalization happens when the student enters repayment.

[1] Half-time is defined as at least 6 undergraduate semester credits per semester for undergraduate students and at least 6 graduate semester credits per semester for graduate students.

Frequently Asked Questions

Federal Direct Loan FAQs

Your first step is to complete the FAFSA. ACHS will use the information from your FAFSA to determine how much student aid you are eligible to receive. Direct Loans are one component of your award package, which may contain other types of aid such as a Federal Pell Grant for eligible undergraduate students.

When you receive a Federal Direct Loan for the first time, you must complete a Master Promissory Note (MPN) online. The MPN is a legal document in which you promise to repay your loan amount and any accrued interest and fees to the Department of Education. Taking out a student loan comes with tremendous responsibility. Loan funds must be repaid, on-time starting after the 6-month grace period following graduation, withdrawal, or drop below half-time enrollment.

The MPN also explains the terms and conditions of your loan. In most cases, one MPN can be used for loans that you take out over several years of study. If you previously signed an MPN to receive a FFEL Program loan, you will need to sign a new MPN for a Direct Loan.

Defaulting on a student loan has many serious implications. First, defaulting on your loan(s) can affect your credit rating and impact your future eligibility for student loans. In addition to the other personal consequences, defaulting on your loan also jeopardizes the institution’s eligibility for participation in student loan programs and could mean that other students just like you could be denied access to student loan funding. ACHS is here to support you academically and financially. We will do everything we can to ensure you have all the information you need to ensure access to graduate opportunities and timely repayment of your student loans.

All students are required to complete loan entrance counseling prior to the award of federal student loan funds.

Below are the maximum annual and aggregate (total) loan limits for Subsidized and Unsubsidized Federal Direct Loans. Students can have one type of loan or a combination of both.

| Year | Dependent Undergraduate Student (except students whose parents are unable to obtain PLUS Loans) | Independent Undergraduate Student (and dependent students whose parents are unable to obtain PLUS Loans) | Graduate and Professional Degree Student |

| First Year | $5,500 – No more than $3,500 of this amount may be in subsidized loans. | $9,500 – No more than $3,500 of this amount may be in subsidized loans. | $20,500 – No more than $8,500 of this amount may be in subsidized loans. |

| Second Year | $6,500 – No more than $4,500 of this amount may be in subsidized loans. | $10,500 – No more than $4,500 of this amount may be in subsidized loans. | |

| Third and Beyond (each year) | $7,500 – No more than $5,500 of this amount may be in subsidized loans. | $12,500 – No more than $5,500 of this amount may be in subsidized loans. | |

| Maximum Total Debt from all Direct Loans When You Graduate (aggregate loan limits) | $31,000 – No more than $23,000 of this amount may be in subsidized loans. | $57,500 – No more than $23,000 of this amount may be in subsidized loans. | $138,500 – No more than $65,500 of this amount may be in subsidized loans. The graduate debt limit includes Direct Loans received for undergraduate study. |

Please note: You cannot borrow more than your cost of attendance minus any other financial aid you get; therefore you may receive less than the annual loan limits. Also, the annual loan limits assume that your program of study is at least a full academic year. The annual and total loan limits include any Direct Stafford Loans you may have received under the FFEL Program.

Graduate and professional students enrolled in certain health profession programs may receive additional Unsubsidized Direct Loan amounts. For these students, there is also an increased aggregate loan limit of $224,000 (maximum $65,500 subsidized).

ACHS recommends that students borrow just enough to cover the cost of tuition, books, and materials. Remember, these loans must be repaid.

Please also note: Effective July 1, 2012, graduate and professional students are no longer eligible to receive Direct Subsidized Loans. The $65,500 subsidized aggregate loan limit for graduate or professional students includes subsidized loans that a graduate or professional student may have received for periods of enrollment that began before July 1, 2012, or for prior undergraduate study.

ACHS receives federal financial aid funds through electronic funds transfer and applies funds directly to your student account. If the funds ACHS receives exceed current term charges, a stipend will be sent by check, unless you give the school written authorization to hold the funds until later in the enrollment period.

Learn more about interest rates online here.

Prior federal loans and financial aid history – If you previously received federal loans and would like to check the interest rate, servicer information, and other financial aid histories, log in to studentaid.gov.

Interest rate cap for military members: If you qualify under the Service Members Civil Relief Act, the interest rate on loans you obtained before entering military service may be capped at 6 percent during your military service. You must contact your loan servicer to request this benefit. You can also learn more about other non-loan military education benefits you may qualify for online here.

Yes, there is a loan origination fee on all Direct Subsidized, Unsubsidized and PLUS Loans equal to a percentage of the amount of each loan you receive. The origination fee is disclosed during the loan process.

When you receive your first Direct Loan, you will be contacted by the servicer for that loan, whom you will repay. Your loan servicer will provide regular updates on your Direct Loan(s). If you’re not sure who your loan servicer is, you can look it up at studentaid.gov. Exit counseling is required when you graduate, leave school, or drop below half-time enrollment, which will provide all of the information you need to meet your student loan financial obligations.

After you graduate, leave school or drop below half-time enrollment, you will have a six-month grace period before you begin repayment. During this period, you’ll receive repayment instructions from your loan servicer, including your first-payment due date. Payments are usually due monthly. Students enrolled less than half-time are not eligible for federal student loans.

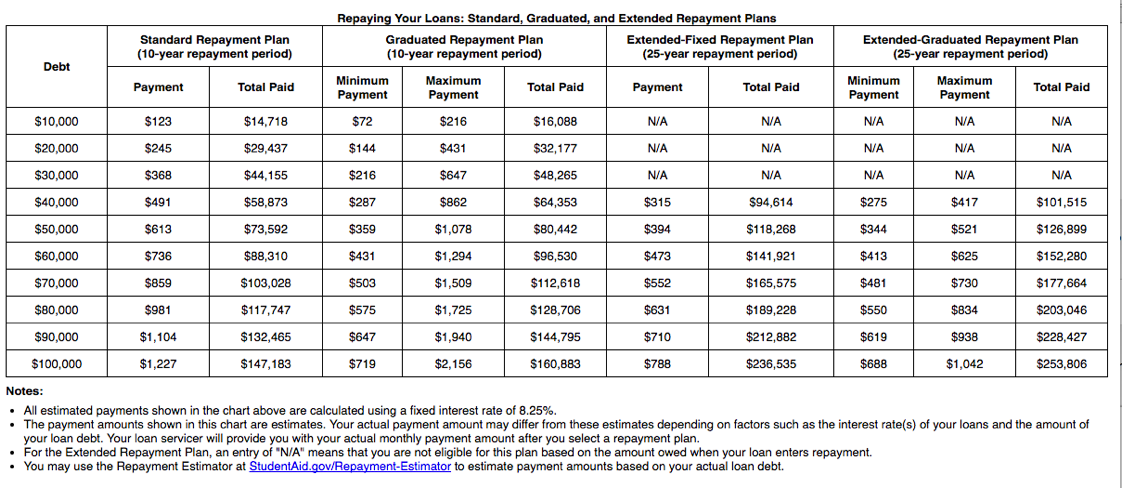

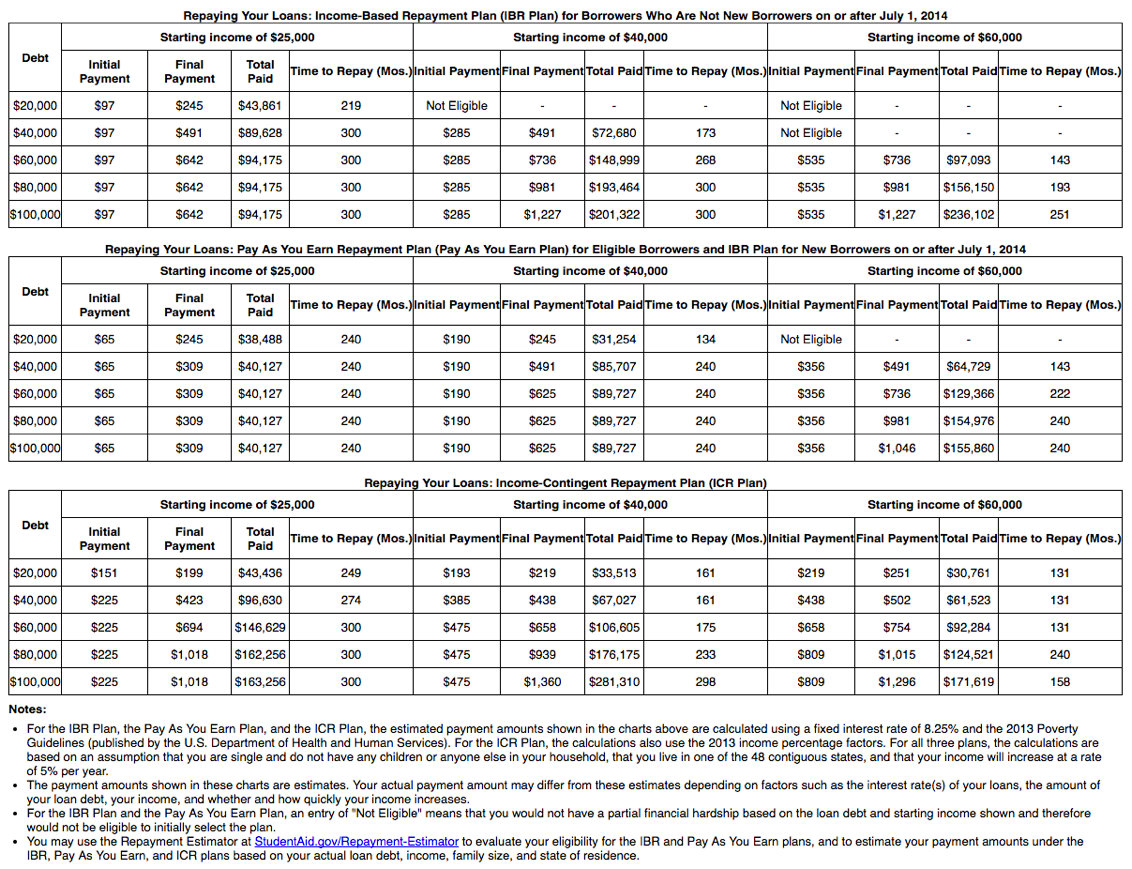

Yes, they offer several repayment plan options. Generally, you’ll have 10 to 25 years to repay your loan, depending on the repayment plan that you choose. You will receive more detailed information on repayment options during ACHS’s entrance and exit counseling sessions. Learn more about Direct Loan repayment plans.

Sample Repayment Schedule

The following link will take you to the U.S. Department of Education’s Direct Loan “Calculators and Interest Rates” webpage where you can estimate your repayment amounts under each of the available repayment plans: https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action.

Under certain circumstances, you can receive a deferment or forbearance that allows you to temporarily stop or lower the payments on your loan. Learn more about your options here.

Yes, but only under a few circumstances. Learn more about having your student loan discharged as well as different forgiveness programs availability for federal student loans here. You also may qualify for forgiveness of some or all of your loan balance if you teach full time for five years at a school or educational service agency serving low-income families and meet other requirements, or after you have made 120 payments on a Direct Loan while employed in one of certain public service jobs (additional conditions apply).

FSA Ombudsman Group

The Federal Student Aid Ombudsman Group is a neutral resource that serves as a last resort to support you to resolve any federal student loan disputes. You can view resources for disputing your loan(s) online here. You can also learn more about your next steps if your dispute(s) are not resolved to your satisfaction online here or via phone at 877-557-2575; fax to 606-396-4821; or mail to FSA Ombudsman Group, P.O. Box 1854, Monticello, KY 42633.

Industry Leaders

ACHS Partnerships & Affiliations